Navigating The Real Estate Market

Fix-and-Flip Funding Tips

If you're diving into real estate investing, especially fix-and-flip projects, understanding financing is key to your success. Getting the right funding can make or break your project. ...more

Real Estate

August 15, 2025•2 min read

Airbnb Market Trends

If you're thinking about diving into the Airbnb space, you're not alone. With more people traveling, working remotely, and looking for alternatives to traditional hotels, short-term rentals are boomin... ...more

Real Estate

August 13, 2025•4 min read

Airbnb & Short-Term Rentals: A Complete Guide to Maximizing Your Investment

If you’ve ever thought about turning a property into a money-making machine, Airbnb might be your golden ticket. Short-term rentals have exploded in popularity, offering property owners a lucrative al... ...more

Airbnb & Short-Term Rentals

March 12, 2025•3 min read

Boost Your Real Estate Profits with Fix and Flip Financing

Learn how to get started ...more

Real Estate

March 11, 2025•6 min read

Financing & Funding Options

Explore various ways to finance your real estate investments, from traditional mortgages to hard money loans and creative financing. Get expert advice on securing the best funding for your next deal. ...more

Types of Investor Real Estate Financing Options

March 10, 2025•5 min read

Rental Property Investing

Discover the keys to building a profitable rental portfolio. Whether you're a first-time landlord or a seasoned investor, we provide insights on cash flow, property management, and tenant retention. ...more

Rental property

March 10, 2025•4 min read

Empowering Dreams: Unveiling Our Identity

We are more than a company; we are architects of inspiration, champions of aspirations, and facilitators of dreams. Rooted in the belief that every dream holds the potential for greatness, we have sculpted our identity around the mission of empowerment.

100% Financing

10% Closing Cost

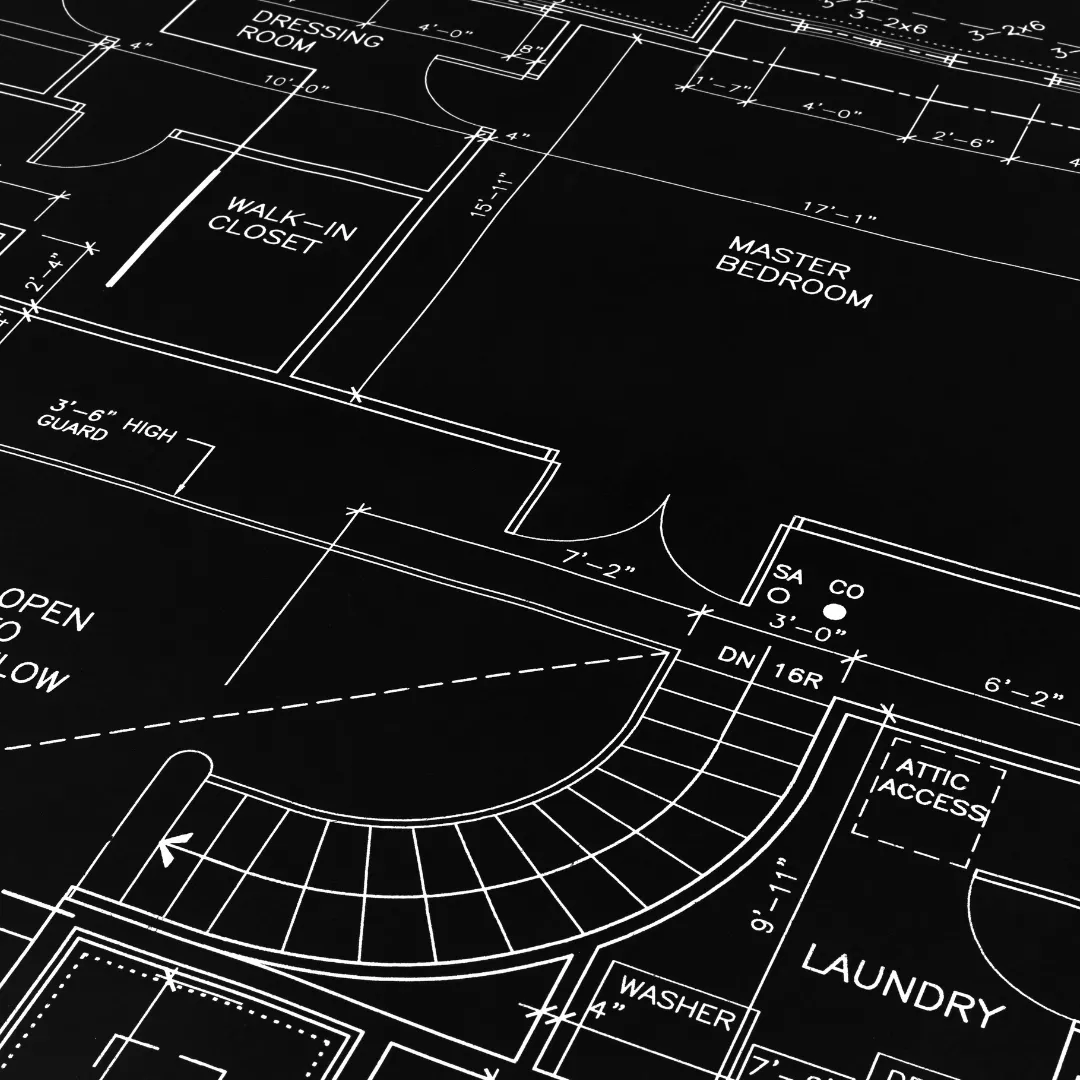

We help identify prime locations for your commercial project, considering factors such as accessibility, zoning regulations, and market potential.

Fix & Flips

From concept to execution, we ensure that your commercial development aligns with your vision, industry standards, and local regulations.

17K

Project Done

2K+

Happy Client

94%